Inside Musk’s Aggressive Incursion Into the Federal Government

PLUS: Hnry takes on the UK, Nicola Willis hints at tax changes, Trump’s trade war fallout for NZ, OpenAI’s new expert-level ChatGPT tool, fixing NZ’s productivity slump, Waipā’s new tech meetup + more

Welcome to Wednesday.

There’s a lot going on 👀 And it’s still impossible to open a news site without Trump or Musk dominating the headlines.

Today, we’re opening up the paywall so you can see exactly what we do—how we break down the news, the stories we surface, and why supporting us with a $145 annual sub (less than a day at a conference, around the cost of 25 coffees, and business deductible) helps us do it even better.

Here’s your Daily Shot:

☕ Hnry Expands to the UK, Targeting Sole Traders After Two Years of Preparation

💰 Nicola Willis Eyes Business-Friendly Tax Tweaks Ahead of Budget 2025

🌏 Trump’s Trade War: What Tariffs Mean for New Zealand

🤖 OpenAI Unveils ‘Deep Research’ – A ChatGPT Tool for Instant Expert-Level Analysis

📈 Fixing NZ’s Productivity Problem: Innovation, Investment & Smarter Policies

🚀 Waipā Tech Meetup #1: Global Startup Success with Investor David Booth

🌍 Feeling Overwhelmed by Climate News? This Podcast Will Help

Got news? Good stuff? Just want to say hi? Drop us a note: hello@caffeinedaily.co. We love hearing from you.

Lauren & the Caffeine team

Scaling compliance made easy

Unlock bigger deals, enter new markets, and prove trust as you grow—all for a fraction of the time and money.

Vanta automates up to 90% of the work needed for SOC 2, ISO 27001, CPS 234, Essential 8 and more—saving you hundreds of hours and up to 85% of the cost.

Vanta’s compliance programme makes it simple to lay crucial security foundations that scale as you grow. Join 8,000 companies like Atlassian, Dovetail, InDebted, Sharies and Flossie that use Vanta to build trust and prove security in real time.

AWS re:Invent re:Cap: Your 2025 Advantage

🚀 Stay ahead of the curve with an exclusive AWS re:Invent re:Cap networking event.

Join industry peers to unpack the latest AWS announcements and innovations designed to help you work smarter in 2025. Connect over drinks and food while gaining insider insights from the AWS team.

🔹 Why attend?

✔ Get a comprehensive breakdown of key AWS re:Invent updates

✔ Network with tech leaders and innovators

✔ Start 2025 informed and ahead of the game

Inside Musk’s Aggressive Incursion Into the Federal Government: In just two weeks, Elon Musk has turned the US federal government on its head, bypassing career officials, seizing control of key agencies, and pushing his ideological vision with unprecedented speed and force. Backed by President Trump, Musk has already taken drastic steps to dismantle parts of the bureaucracy, shut down agencies, and purge civil servants he deems part of the so-called “deep state.” Here we breakdown a deep dive from the New York Times.

Musk’s influence extends across at least half a dozen government agencies, including the Treasury Department, USAID, and the Office of Personnel Management. His team—made up of young engineers from Silicon Valley, many with no government experience—has been granted sweeping access to financial systems, data networks, and hiring decisions. At Treasury, officials who resisted were removed, and Musk’s team now has visibility into federal payment systems that process trillions of dollars.

Perhaps most shocking is Musk’s rapid takedown of USAID, the federal agency responsible for foreign aid. Over the weekend, he boasted that his team had “fed USAID into the wood chipper,” freezing funding, terminating contracts, and even removing the agency’s website. His moves have sent shockwaves through Washington and the international community, leaving US allies scrambling to understand the consequences.

Musk’s unchecked power is raising serious concerns over conflicts of interest. As the head of Tesla, SpaceX, and X, he has billions in government contracts and deep ties to foreign markets, including China. Despite this, he has been given the ability to shape federal policy and oversee agencies that regulate his own businesses. Trump, while occasionally offering cautionary words, has largely let Musk run wild, praising his cost-cutting efforts and granting him immense authority.

Musk’s takeover is already reshaping the government workforce. His team has flooded federal employees with messages calling them lazy and urging them to quit. At the Office of Personnel Management, staff received an email offering them a chance to resign with severance—eerily similar to Musk’s infamous Twitter purge in 2022. The General Services Administration, which manages federal properties, is bracing for budget cuts of up to 50%.

Meanwhile, Musk is pushing for AI-driven decision-making in government spending, proposing a system that would analyse and recommend cuts across all federal contracts. His broader goal? A radical reduction in the size of government, with a focus on slashing spending and eliminating agencies he sees as wasteful.

Democrats and watchdog groups are alarmed, warning that Musk’s actions may violate federal laws designed to protect government institutions and prevent personal financial gain. Lawsuits have already been filed, but Musk’s speed and Trump’s backing mean legal challenges may struggle to keep up.

With Musk operating with near-total autonomy and little oversight, the question now is whether Congress will step in to rein him in—or if this is just the beginning of a full-scale dismantling of the federal government as we know it.

Hnry Expands to the UK, Targeting Sole Traders After Two Years of Preparation: New Zealand-founded fintech Hnry has officially launched in the UK, extending its automated tax service to sole traders in a market twice the size of New Zealand and Australia combined. After two years of preparation and a $35 million Series B capital raise, NBR [paywalled] shares the Wellington-based company is poised for strong growth and profitability in 2025.

A Perfect Timing for Expansion: Hnry’s UK launch aligns with the government’s Making Tax Digital initiative, which will soon require self-employed individuals earning over £50,000 ($109,000) to maintain digital tax records and file returns using compatible software. This regulatory shift creates a prime opportunity for Hnry to support the UK’s estimated four million sole traders.

Leadership & Strategy: The UK operations will be led by Manasé Mtopa, a seasoned accountant with experience in Lloyd’s Banking Group and Experian. Hnry co-founder and CEO James Fuller emphasised the company’s commitment to understanding the UK market, noting that expats and freelancers have already shown strong demand for the platform.

Growth Trajectory & Profitability: Hnry has grown its Australasian market by 58% in the last two years, with revenues more than doubling since the Series B raise. Fuller highlighted that despite tough economic conditions in New Zealand, Hnry is thriving, with Australia performing exceptionally well.

What’s Next? While Hnry is eyeing further European expansion, the focus remains on building its UK customer base. A waitlist is now open, and the company is confident that its customer-driven approach will drive rapid adoption.

With a scalable model, strong financial backing, and a clear market need, Hnry’s UK move marks a significant milestone in its global journey.

Nicola Willis Eyes Business-Friendly Tax Tweaks Ahead of Budget 2025: Finance Minister Nicola Willis is signalling potential changes to New Zealand’s tax system in a bid to make it more competitive and attractive to businesses and investors. Speaking ahead of Budget 2025, set for May 22, Willis acknowledged that New Zealand’s corporate tax rate of 28% is higher than the OECD average of 24% and suggested this could warrant a review.

She also indicated she is “receptive” to revisiting the Foreign Investment Fund (FIF) tax regime, which has long been criticised for penalising both Kiwis investing in offshore entities and wealthy immigrants moving to New Zealand. The FIF tax rules require investors with more than $50,000 in offshore investments to pay income tax on 5% of their shareholding’s value annually—regardless of whether they receive any actual income. Critics argue this discourages foreign investment and could push high-net-worth individuals out of the country.

Inland Revenue is currently reviewing the FIF regime, and Willis suggested a key fix could be ensuring tax is only applied when investors receive income. She noted urgency in addressing this issue, as a wave of wealthy individuals who moved to New Zealand during the pandemic may soon reach the end of their four-year tax exemption.

Beyond FIF, Willis said the Government is considering a range of tax tweaks to support business growth. These include simplifying compliance costs, revisiting fringe benefit tax, and adjusting capital expenditure rules that currently force businesses to capitalise purchases over $1,000 instead of treating them as expenses. However, one thing that’s off the table? Allowing commercial and industrial property owners to claim depreciation deductions—something the coalition Government recently cut to raise revenue.

While emphasising that tax changes alone aren’t a “silver bullet” for economic growth, Willis said they must be considered alongside broader reforms, including changes to resource consenting, foreign investment rules, and employment laws. With Government debt set to keep rising as a percentage of GDP, any tax adjustments will need to be carefully balanced against fiscal sustainability.

At $17 billion, corporate tax currently makes up 14% of the Crown’s tax revenue, and Willis acknowledged that while any tax cuts might create short-term revenue gaps, they could also stimulate business growth and ultimately bring in more tax. She also hinted at a mix of quick fixes and longer-term structural changes, reinforcing that the Government’s priority is keeping New Zealand an attractive place for businesses to grow. More here.

Trump’s Trade War: What Tariffs Mean for New Zealand: Donald Trump has thrown the global trade rulebook out the window, escalating his tariff war with major trading partners. Over the weekend, the US President announced sweeping new tariffs—25% on Mexican and Canadian goods and 10% on Chinese imports—sending shockwaves through markets and prompting fears of inflation and economic disruption. While some last-minute deals have temporarily delayed the full impact, Trump’s aggressive approach is already reshaping global trade, and New Zealand won’t be immune. Liam Dann dives deep into the impact for NZ.

What Are Tariffs and Who Pays? At their core, tariffs are taxes on imported goods, a protectionist tool used to make foreign products more expensive and incentivise domestic production. Despite Trump’s claims that foreign companies will foot the bill, the reality is that US importers must pay these taxes when bringing goods into the country. Those costs are then passed down the supply chain—either absorbed by businesses, pushed onto consumers, or forcing exporters to slash prices to remain competitive.

Why Tariffs Mean Higher Prices (and Less Growth): For New Zealand, Trump’s tariffs could have ripple effects on inflation, interest rates, and exports:

Higher US Inflation → Higher Interest Rates

Tariffs push up prices, feeding inflation in the US. That forces the US Federal Reserve to keep interest rates high, which then lifts borrowing costs globally—including for New Zealand. This makes mortgages more expensive and weakens economic growth.A Weaker Kiwi Dollar → More Expensive Imports

As US interest rates rise, the US dollar strengthens, driving down the value of the Kiwi dollar. A weaker Kiwi means higher prices for imported goods—especially petrol—which adds to the cost of living.Stock Market Volatility → KiwiSaver Risk

Uncertainty in global markets could trigger sell-offs, affecting share prices and hitting KiwiSaver balances. Investors are already jittery, and any further escalation could spark a correction or crash.Could There Be a Silver Lining? Some economists suggest New Zealand might see a slight benefit if surplus goods originally bound for the US get redirected to tariff-free markets like ours, lowering prices. However, any advantage would likely be short-lived, as broader economic instability outweighs minor savings at the checkout.

The Big Risk: Retaliation Against NZ Exports: New Zealand isn’t currently in Trump’s firing line, but if tariffs extend to Kiwi products—especially beef, dairy, or tech—the consequences could be severe. The US is now our second-largest export market, and while we enjoy favourable trade quotas, Trump’s history of protectionist moves means nothing is guaranteed.

The China Factor: Perhaps the biggest risk isn’t what Trump does directly to New Zealand, but how his tariffs hit China—our largest trading partner. If China’s economy slows further due to US tariffs, demand for Kiwi exports like dairy, forestry, and tourism could take a major hit. A weaker Chinese economy also means less spending power for consumers, which could dent New Zealand’s recovery just as it’s gaining momentum.

Why Economists Hate Tariffs: While Trump frames tariffs as a way to protect American jobs, most economists see them as outdated, inefficient, and ultimately damaging. Protectionism discourages innovation, raises costs, and creates market distortions—lessons New Zealand learned firsthand in the heavily protected economy of the 1950s-70s.

A High-Stakes Gamble: Trump’s tariff war is a global economic experiment with enormous risks. While he sees it as a power play to strengthen America, history suggests it could backfire—driving inflation, slowing growth, and triggering economic instability worldwide. For New Zealand, it’s a waiting game, but one with real consequences for our economy, businesses, and everyday costs.

OpenAI Unveils ‘Deep Research’ – A ChatGPT Tool for Instant Expert-Level Analysis: OpenAI has launched Deep Research, a powerful new ChatGPT tool designed to automate complex internet searches and generate expert-level reports in minutes. Aimed at professionals in finance, science, policy, and engineering, the AI agent can independently browse the internet, extract data from multiple sources, and produce fully cited research reports—all within 5 to 30 minutes, a task that would take humans hours.

Available to Pro users for $200 a month, Deep Research is powered by a fine-tuned version of OpenAI’s o3 reasoning model. Unlike traditional ChatGPT tools, this agentic AI dynamically adjusts its approach in real time, making it more autonomous and adaptable. OpenAI claims it has already outperformed GPT-4, achieving a record-breaking 26.6% score on "Humanity’s Last Exam," an AI benchmark for expert-level reasoning. However, the company cautions that the model can still hallucinate incorrect facts and struggle with distinguishing rumors from verified information.

The launch comes amid increasing competition, particularly from Chinese startup DeepSeek, which has shaken the AI industry with its cost-efficient, high-performance model. OpenAI CEO Sam Altman has signaled an aggressive rollout strategy, with Deep Research following last week’s debut of o3-mini, a smaller reasoning AI model. The company is doubling down on innovation, having also introduced Operator AI agents last month and its text-to-video model Sora in December.

As AI arms races escalate, OpenAI is betting that Deep Research will redefine AI-powered information gathering, giving professionals a research assistant that never sleeps—but whether it truly delivers expert-level accuracy remains to be seen. More from Business Insider here.

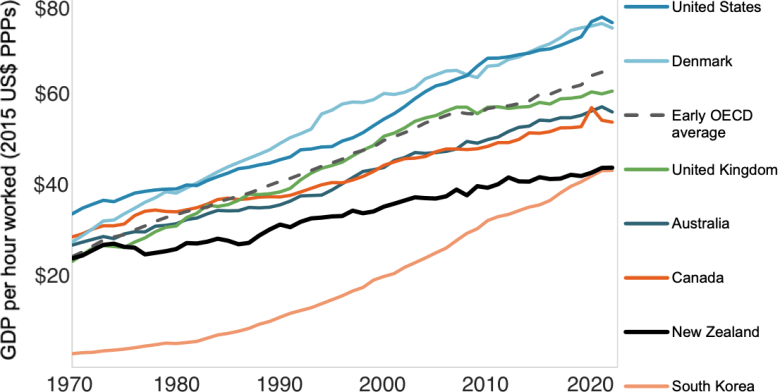

Fixing NZ’s Productivity Problem: Innovation, Investment & Smarter Policies: New Zealand’s productivity crisis is holding back wages, growth, and the quality of life Kiwis expect. While deregulation in the late 1980s briefly boosted productivity, the past 50 years have seen NZ fall behind other developed nations. With an ageing population and increasing demands on social services, improving productivity is more urgent than ever. A great dive from Stewart Forsyth over at Newsroom.

Why Is Productivity Stagnant? Experts agree that innovation, global competition, and scaling up successful businesses are key to lifting productivity. Economist David Skilling emphasises that New Zealand needs more “frontier firms”—globally competitive businesses that drive industry-wide improvements.

However, NZ firms struggle to adopt new technologies and efficiently allocate labour, with too many workers in low-productivity industries. Research shows better management of people and skills can lift business performance by 7-14%, yet many businesses still take an ad-hoc approach to training and pay.

Solutions to Drive Change: Act Party leader David Seymour blames over-regulation for NZ’s productivity struggles, arguing that excessive red tape stifles the Kiwi “can-do” attitude. However, productivity experts suggest that strategic investment could be more effective.

1️⃣ Government-backed investment in frontier firms – A dollar-for-dollar investment scheme supporting NZ’s top firms to grow, invest in R&D, and build local supply chains.

2️⃣ Productivity incentives & scorecards – Recognising top-performing businesses in each sector, rewarding productivity improvements, and creating annual benchmarking reports to drive competition and transparency.

A Global Mindset for Growth: NZ’s productivity gap won’t close with deregulation alone—it requires bold investment in innovation, workforce skills, and scaling globally competitive businesses. With smarter policies, New Zealand can break out of its low-productivity rut and build a more prosperous, high-wage economy.

Waipā Tech Meetup #1: Global Startup Success with Investor David Booth: 🚀 Calling Waipā's tech community! Soda Inc., Rocketspark, and Waipā District Council are teaming up to launch Waipā Tech Meetups, a brand-new series connecting local tech businesses and entrepreneurs with practical insights, networking, and industry expertise.

Event #1: Global Perspectives on Startup Success

🗓 Date: Wednesday, 12 February 2025

🕔 Time: 5:00 – 6:30 PM NZDT

📍 Location: Rocketspark Head Office, Unit I/60 Victoria Street, Cambridge

🥂 Perks: Refreshments, nibbles, and a casual vibeFeaturing Guest Speaker: David Booth, Investor at Blackbird VC

David Booth, a Cambridge local and co-founder of On Deck, brings years of experience helping over 1,000 startups raise $2 billion. Now, through his Diaspora.nz podcast, David shares insights from Kiwi founders succeeding globally. At this meetup, he’ll dive into key lessons from the diaspora and offer practical advice for Waipā-based founders on tech, startups, and investing.What’s on offer?

🔑 Expert insights – Learn from David’s global startup experience

🤝 Networking – Meet local founders, tech experts, and entrepreneurs

🍷 Drinks & nibbles – Unwind in a welcoming, relaxed atmosphereDon’t miss the chance to be part of Waipā’s growing tech ecosystem.

Spots are limited, so register now to kick off 2025 with fresh ideas, new connections, and inspiration from global startup success stories.

Feeling Overwhelmed by Climate News? This Podcast Will Help

🟢 Episode 42: Facing Climate Anxiety—Practical Tools for Hope with Dr. Susie Burke and Brianne West.

If climate change is making you feel anxious, frustrated, or even hopeless, this episode is for you. Psychologist Dr. Susie Burke breaks down the emotional toll of climate change and how to stay hopeful and take action—without falling into apathy.

🔹 Why listen?

Learn practical strategies to manage climate distress.

Understand the “perception gap”—why more people care than you think.

Get a fresh perspective on solutions and why there’s still hope.

This uplifting conversation is a must-listen for anyone feeling overwhelmed by the state of the planet. Tune in and find out how you can turn anxiety into action.

That’s it for today, thanks for reading. Want to get in touch with a news tip, bit of feedback or just to chat? Email hello@caffeinedaily.co