Venture Capital 101: Raising VC vs funding alternatives

News from New Zealand's startup ecosystem, straight to your inbox.

Good morning Caffeinators,

Happy Thursday!

The weekend is in sight and while the weather is still pretty dire at least interest rates look slightly less so.

As well as your usual Daily Shot of news, a lot of which is unpacking the recent cut, we’re also taking a global look at what’s happening in hot markets around the world.

And thanks to Icehouse Ventures, we’re debuting a new feature series from Icehouse Partner Jo Wickham, unpacking the all important capital raise and what options are on the table.

Sit back, sip that coffee and enjoy your Caffeine.

Finn & the Caffeine team

OCR relief: The expected 50 point cut to the OCR was unveiled yesterday. While relief on the costs of borrowing can be rapid, the question of how soon this will make its way through the wider economy is harder to answer. Susan Edmunds did a good job of it over at RNZ though, speaking to several experts for their take with the consensus seeming that it’ll take time for the full effects to be felt but the signal sent by the cut provides at least a partial boost immediately. With another 50 point cut expected in November, it does certain feel like we’re turning a corner. More here.

Don’t cheer just yet: Meanwhile Liam Dann over at the Herald is pouring a little cold water on the OCR celebrations, writing: “Remember we need to pinch ourselves and remember that central banks don’t deliver outsized cuts to interest rates unless the economy is in very bad shape. Read more here.

US Government Weighs Break-up of Google in Landmark Antitrust Case: The U.S. Department of Justice (DoJ) is considering breaking up Google to address its monopoly in search, following a court ruling in August declaring Google a “monopolist” under U.S. antitrust law. Proposed remedies include forcing Google to share search data with rivals, banning exclusive contracts like the $20 billion deal with Apple, and restricting its use of AI features. Google has rejected the measures as "radical" and plans to appeal. The case is the biggest antitrust action since Microsoft’s in 2000, and hearings are set for April 2025, with a decision expected by August. Read more here.

Scaling Success: Mikayla Hopkins on Leading Tracksuit’s Global Marketing Efforts: This week on Wild Hearts, a Blackbird podcast, the team talk to Mikayla Hopkins, Head of Marketing at Tracksuit, about her evolution from individual contributor to marketing leader. As Tracksuit scales globally, Mikayla discusses their unique marketing strategy, key performance metrics, the tools powering their operations, and how she adapted to grow with the company. If you're curious about scaling teams and brands, this episode is for you! 🎙️ Listen here.

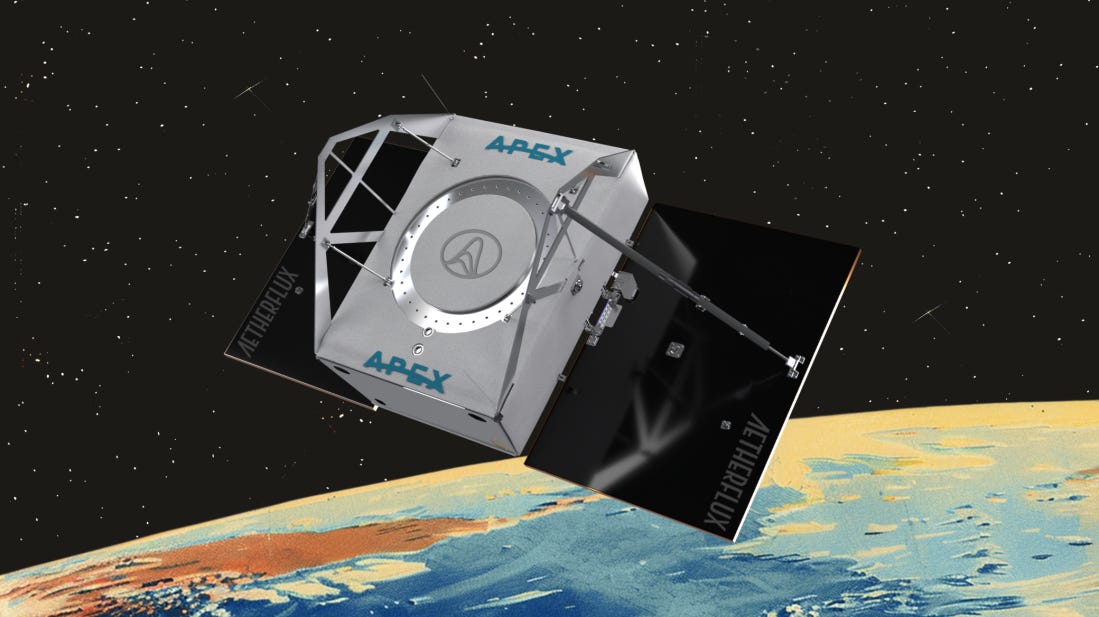

Solar satellites: One of the most exciting consequences of the recent boom in aerospace technologies is the almost sci-fi level startups its making feasible. Solar power satellite startup Aetherflux has left stealth, promising a radical new vision for power generation based on the very oldest. Sending thousands of satellites into orbit and beaming energy back directly to Earth by soaking up sunlight uninterrupted by our atmosphere.

Synthetic data: Really interesting AI wrap from Tech Crunch here addressing one of the key issues holding back the AI industry: its running out of data to train its models. This is prompting tech titans to embrace ‘synthetic data’, essentially training AI using its own outputs in an endless snake eating its own tail situation. While it could help break through the current chokepoint, it does raise questions of how reliable the outputs will be long term when humans are almost completely removed from the loop.

Another Nobel for AI: For the second time this week, a key figure in AI has won a Nobel prize. Professor Demis Hassabis is sharing the Nobel Prize for Chemistry for his work on proteins, the building blocks of life. Hassabis co-founded the artificial intelligence company which became Google DeepMind and helped create ‘AlphaFold’, the medical AI which can accurately predict the structure of essentially all possible proteins. This can radically transform our ability to discover new drugs to treat old diseases.

Welcome to a brand new three-part series with Icehouse Ventures Partner, Jo Wickham.

Venture Capital 101: Raising VC vs funding alternatives

Raising capital is one of the biggest decisions a startup founder will face. If you're a regular Caffeinator, you've probably noticed that venture capital (VC) tends to grab the spotlight. It promises rapid growth, industry connections, high-profile events, and PR buzz around big funding announcements. But here's the thing—VC isn't always the best option, in fact, it’s rarely the best option, especially in the early stages of a startup. So, how can you tell when it’s the right time to go for VC funding? And what other options should you consider if VC doesn’t feel like the best fit?

When VC funding makes sense

Everyone loves the Olympics and a good analogy so, think of raising venture capital as being like competing in the Olympics. If your startup is ready to go for gold—meaning you’ve trained hard, perfected your craft, and are prepared for the world stage—VC funding can be the sponsor that gets you the top-tier coaches, world-class equipment, and access to the best competitions.

If you're still figuring out your sport or honing your skills, raising VC is like entering the Olympics before you're ready— you might end up burning out or missing out on the right opportunities because the timing isn’t right yet or worse, your startup might end up the venture backed equivalent of Raygun.

Perhaps you are a world-class talent with local ambitions, then raising VC funding might steer you towards goals that aren’t aligned with that ambition and may mean you’re training for a competition that you never wanted to enter, let alone win.

So, when does VC funding make sense, and when is a good time to raise?

If CAFFEINE matters to you, here’s how you can back us:

Founders: Become a CAFFEINE patron and help others achieve what you have. Make a donation of your choice on the button below or drop us a line.

Startup leaders: Buy a discounted subscription for your team to keep them informed and inspired. Click the ‘group’ plan on the subscribe page.

Corporates & Brands: Partner with us and show your commitment to our startup ecosystem. Buy a day, run an event, create some paid content, back our pods.

Readers: Subscribe for $15 bucks a month. Every bit helps. If you're not in a position to support please consider sharing the free feed with friends or family.

🚀 Together, let’s fuel the next wave of New Zealand startups.

That’s it for today, thanks for reading. We’ll be back tomorrow morning. Want to get in touch with a news tip, bit of feedback or just to chat? Email hello@caffeinedaily.co.